Blockchain technology has changed how money moves across the world. Criminal groups think crypto offers them a shield for illegal acts. They’re wrong. The open nature of blockchain creates clear tracks for law enforcement to follow. Every transaction leaves a permanent mark on the digital ledger, creating a rich trail of evidence for investigators.

Financial crimes become more complex yearly, and criminals constantly adapt their methods. However, blockchain’s clear record gives law enforcement new ways to fight back. They can now trace funds across many wallets and exchanges and spot links between criminal groups that once stayed hidden. This article shows how agencies use blockchain data to catch financial criminals.

The Potential of Blockchain Analytics in Law Enforcement

Blockchain analytics gives law enforcement tools they never had before. Old-style financial crimes often went cold when money vanished offshore. Now, every crypto transfer stays visible forever. Special analysis tools can track these movements across the entire blockchain. They can flag odd patterns that match known criminal actions.

These tools keep getting better with new tech advances. They can now link groups of wallets to the same owner and spot money laundering tricks across thousands of accounts. This helps police work smarter and focus on the most promising leads.

Real-Time Incident Response

Law enforcement now watches blockchain transfers as they happen. This marks a huge shift from waiting for crime reports after the fact. Teams can jump into action the moment suspicious transfers appear. This quick response can stop criminals from cashing out stolen funds.

The 2022 Axie Infinity hack shows why this matters. Hackers stole $625 million in crypto assets. Blockchain watchers tracked the funds moving between exchanges. Police and exchange security teams worked together. They froze millions in stolen assets before they could vanish forever. This happened because they could see the theft unfold in real time.

Illicit Actor Attribution

Finding the real people behind crypto crimes remains hard but not impossible. Blockchain leaves clues that help identify criminal groups. Each group tends to use certain tactics over and over. These digital habits create unique signs that point to specific actors.

The Silk Road case proves this works. FBI agents tracked Bitcoin flows linked to this dark web market. They found transfers between the site’s wallets and personal accounts. These links helped prove that Ross Ulbricht ran the entire operation. The methods used in this case now help catch other crypto criminals.

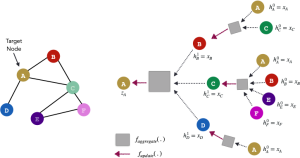

Transaction Clustering and Entity Mapping

Smart analysis tools can group related wallets together, showing which addresses likely belong to the same person or group. This method can help law enforcement map entire criminal networks, helping them see how different criminal services connect to each other.

This approach helped crack several big ransomware gangs. Investigators tracked ransom payments across hundreds of victims. They found shared wallet patterns among different attack groups, revealing fewer gangs than first thought. Many used the same cash-out services and shared profits.

Corroboration from Open-Source Intelligence

Blockchain data works best when mixed with other types of evidence. Social media posts, forum chats, and market listings add vital context. They help confirm who controls certain crypto wallets. They show intent that pure blockchain data can’t reveal.

One Bitcoin exchange hack shows this dual approach in action. Analysts tracked stolen coins across the blockchain. At the same time, other team members watched dark web forums. They caught hackers trying to sell the stolen funds. This twin approach led to arrests that solved the case.

Strengthening Seizures and Asset Recovery

Blockchain analysis directly helps police seize criminal assets. It shows exactly where stolen money is right now, provides the proof needed for court orders, and helps time raids to catch criminals with keys to their wallets.

In 2022, the US Justice Department seized $3.36 billion in bitcoin, the funds from a 2016 exchange hack. Blockchain tracking followed the coins through thousands of moves, leading agents to the suspects’ doorstep. It is the largest crypto seizure in history.

Policy Making and Impact Assessment

Government leaders need facts to make smart crypto rules. Blockchain analysis gives them real data instead of guesswork. It shows which criminal trends pose the biggest threats. It measures whether new laws actually change criminal behavior.

Recent trend reports showed ransomware payments dropped 40% from 2021 to 2022. This data helped prove that new task forces were working. It showed which tactics worked best against these extortion schemes. Such clear metrics help guide future policy choices.

Risk Management and Compliance

Financial firms must stop money laundering through their services. Blockchain analysis tools help them spot bad actors quickly. These tools have grown much more precise in recent years. They find truly risky users while leaving honest customers alone.

Risk Assessments

Banks and exchanges must determine how risky each customer might be. Blockchain history helps make these checks more accurate. It shows whether funds came from sketchy sources or clean ones and flags users with links to known bad actors.

One major exchange rebuilt its risk system last year using AI trained on real blockchain data. The new system caught 40% more suspicious acts, but it bothered honest users much less often. This balance keeps both regulators and customers happy.

AML Transaction Monitoring

Anti-money laundering teams watch for signs of criminal cash flow. Modern tools scan thousands of transactions per second, flagging the ones that match known criminal patterns. This helps firms file accurate reports to authorities.

The best systems combine strict rules with smart learning tech. Rules catch known tricks that always look the same, while learning systems find new patterns humans might miss. Together, they form a strong net that catches most dirty money attempts.

Regulatory Compliance

Crypto firms must follow strict rules about knowing their users. Blockchain analysis proves they’re doing proper checks, helps them show they’re not serving criminals, and creates the paper trail that keeps them safe during audits.

A recent study found that firms using these tools faced fewer fines. They caught problems before they grew serious. They filed better reports with more useful details, saving them money while helping law enforcement catch real criminals.

Transaction Monitoring

Smart monitoring spots strange money moves in real time. It examines where funds came from and where they’re going and checks if amounts, timing, and patterns match known risks. It tells staff which cases need urgent human review.

One system found terrorist funding by spotting a strange pattern. Small sums came from many sources into one wallet. The funds are then split into exact amounts sent to field agents. This pattern triggered alerts that stopped the plot before the money was moved.

National Risk Assessments

Countries must know what crypto risks they face. Blockchain data helps map these threats accurately. It shows which crime types happen most often. It reveals which coins criminals prefer to use.

The UK’s 2020 risk report used such data extensively. It found that ransomware posed the biggest immediate threat. It showed that privacy coins weren’t used as often as feared. These insights helped focus police resources where they’d do the most good.

Supporting Regulatory Enforcement

Regulators use blockchain proof when taking legal action. The ledger provides perfect evidence of rule-breaking. It shows exactly when and how violations happened, making cases much stronger in court.

The SEC used such evidence against firms selling unregistered securities. The blockchain showed exactly who bought what and when, and it proved how much money changed hands. This concrete proof led to quick settlements in several cases.

Licence Application Reviews

Agencies check blockchain records when firms apply for licenses. They look for undisclosed past problems, check for hidden ties to known bad actors, and verify claims about business volume and practices.

One applicant claimed to have strong controls against money laundering. Blockchain checks showed they’d processed funds from known scams. This hidden history led to their license being denied. The public record helped protect consumers from a shady operator.

Conclusion

Blockchain data has changed the game for fighting financial crime. What criminals thought would hide their tracks now exposes them. Law enforcement grows more skilled with these tools each year. Their success shows in rising arrest rates and asset seizures.

Financial firms use the same tools to keep criminals out of their systems. They can spot risks faster and more accurately. They can focus resources on real threats instead of false alarms. This makes the whole system safer for honest users.

The cat-and-mouse game will continue as criminals try new tricks. However, blockchain’s transparent nature gives law enforcement a lasting edge. The future looks bright for those using this technology to protect our financial system.

Also Read: Reasons to Choose a CRM System Over Manual Processes

FAQs

They combine blockchain data with exchange records, IP logs, and old-fashioned police work.

Privacy coins add challenges but don’t guarantee safety. Special techniques now track even these transactions.

It’s crucial since crypto crimes cross borders instantly. Agencies must share data and coordinate raids.

Access varies by budget and training. Many commercial firms now offer services to law enforcement.